Did you know . . .?

What should you do if you are in an auto accident, and get an offer of settlement from the insurance company for $24,000, to cover the cost of repair of your car, and your trip to the hospital to set your broken arm?

You see an injury law firm ad on TV or a billboard telling you they will “go to bat for you!” You think, Yeah, I’ll call them and they will get me more money!

✅ Reality Check. When you walk through the law firm’s door and sign up for their services, their contingency fee of 33% just gave them 1/3 of the insurance money you already negotiated on your own. Yes–$8,000 goes to the firm, and you are left with only $16,000. The firm negotiates a few weeks, and gets you an extra $6,000, bringing your settlement to $30,000! But, do the math. The law firm gets $10,000, and you get $20,000. Sure, the firm got you more money from the insurance settlement, but your $20,000 portion is less than the $24,000 you had when you shook hands with the greasy shyster lawyer. Yes–this is exactly how they pay for that expensive TV advertising, and their fancy houses and cars!

Steps you should follow

Car accidents are stressful, but knowing what steps to take can protect your health, your rights, and your wallet.

This guide walks you through what to do immediately at the scene, how to deal with insurance companies, and when (or if) you should hire a lawyer.

🛑 At the Scene

- Check safety first: Move out of traffic if possible.

- Call 911: Report the crash and request medical help if needed.

- Exchange info: Names, driver’s license, insurance, vehicle details.

- Document everything: Photos of cars, plates, ID, road, injuries, witnesses.

- Don’t admit fault: Stick to facts only.

👉 Pro tip: Even if you feel “fine,” get checked out. Whiplash and internal injuries can show up later.

📋 Dealing with Insurance

- Notify your insurer quickly.

- Keep records of medical bills, repairs, lost wages, and out-of-pocket costs.

- Don’t accept the first offer—adjusters often start low.

- Write a “demand letter”: Clearly list your injuries, costs, and what compensation you expect.

- Wait until fully healed or medically stable before settling, so future expenses are included.

👉 Pro tip: Insurance companies may delay or downplay claims—stay persistent and respond with documentation.

⚖️ Lawyers: Help or Hassle?

- When you may need one:

- Your claim is denied.

- Liability is disputed.

- The offer is unreasonably low.

- Contingency fees explained:

- Standard is 33–40% of your final payout.

- No upfront fee—you pay only if you win.

- You often lose money doing this

🚨 The “Law-Firm Rip-Off” Warning

You’ve heard the ads: “In a wreck? Get a check!”

Here’s the reality:

- Some firms sign clients after insurance money is already coming, then take a full cut (often one-third or more) whether or not they improved the settlement.

- Contingency fees are meant to help those who can’t afford hourly lawyers—but they also create pressure to settle quickly, even if holding out might get you more.

- Ambulance chasing (lawyers soliciting crash victims directly) is considered unethical and is a red flag.

👉 Protect yourself:

- Ask exactly what percentage they’ll take, and if that includes the base offer, or only the excess they negotiate. Ask of % changes if the case goes to trial.

- Compare law firms before signing.

- Don’t be pressured into fast settlements.

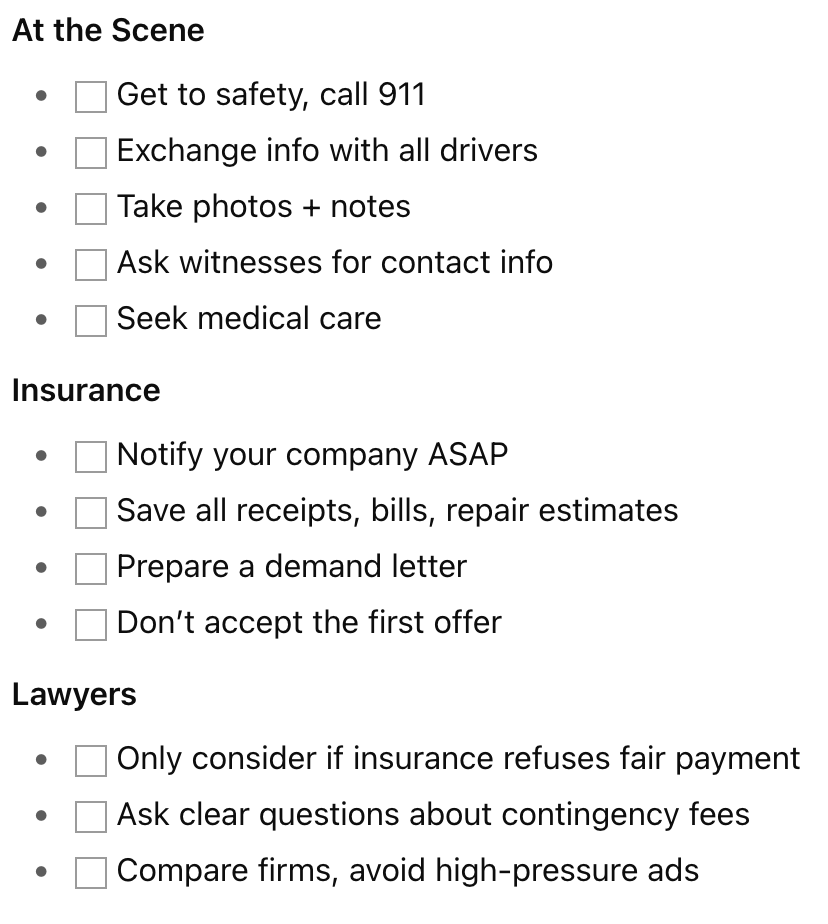

✅ Quick Checklist

🔑 Key Takeaway

Handle the basics yourself first: document, negotiate, and stay persistent. Only consider a lawyer if you’ve hit a wall with insurance—and be cautious of firms that promise quick checks but take a big bite of your payout.