Taxes may seem confusing, but understanding the basics helps you avoid mistakes and keep more of your money.

Here’s a breakdown of the most common forms and how to file your taxes with confidence.

📄 The W-4 Form (When You Start a Job)

- Filled out when you’re hired.

- Tells your employer how much tax to withhold from your paycheck.

- The more allowances/exemptions you claim, the less money is withheld (but you may owe more at tax time).

- The fewer allowances, the more is withheld (you may get a refund later).

👉 Pro tip: Use the IRS online W-4 calculator to avoid under- or over-withholding.

💵 The W-2 Form (At Year’s End)

- Sent by your employer in January.

- Shows how much you earned and how much tax was withheld.

- You’ll use this to file your tax return.

📝 Filing Basics

- Decide how to file:

- Online tax software (TurboTax, H&R Block, Free File through IRS).

- Hire a tax preparer (good if you have complicated finances).

- Paper filing (slower, less common).

- Collect documents:

- W-2 from your employer.

- 1099 forms if you did freelance/contract work.

- Receipts for deductions (education expenses, charitable donations, medical costs).

- Choose your filing status:

- Single, Married Filing Jointly, Married Filing Separately, Head of Household.

- Know deadlines:

- Federal tax returns are usually due April 15.

- You can request an extension (but you still must pay estimated taxes on time).

📊 Refunds vs. Owing

- If too much tax was withheld → you get a refund.

- If not enough was withheld → you owe money to the IRS.

- Refunds are not “free money” — it just means you overpaid during the year.

🛠️ Tips to Make It Easier

- File early to avoid last-minute stress.

- Double-check your Social Security number.

- Keep copies of past tax returns.

- Don’t ignore IRS letters — deal with them promptly.

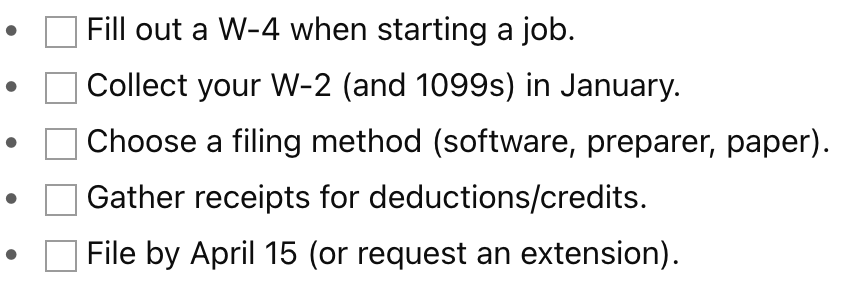

✅ Quick Checklist

🔑 Key Takeaway

Taxes don’t have to be scary. Learn your forms, keep your paperwork organized, and file on time — and you’ll stay stress-free (and penalty-free).