Your credit score is like a financial report card.

It shows how reliable you are at borrowing and paying back money; and it affects everything from loan approvals to apartment rentals.

📈 What Is a Credit Score?

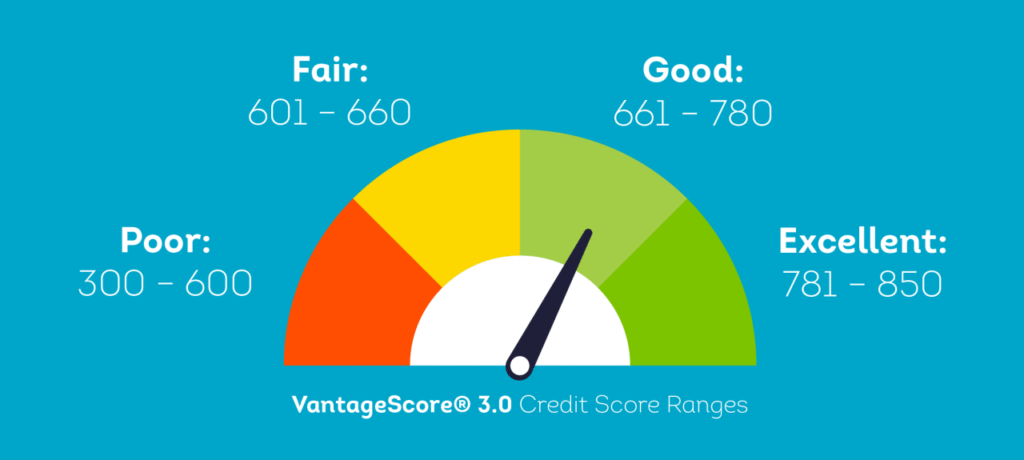

- A three-digit number (300–850) that measures your creditworthiness.

- Higher scores = lower risk for lenders.

- Used by banks, landlords, credit card companies, even some employers.

🧮 How Credit Scores Are Calculated

Credit scoring models (like FICO) use these factors:

- Payment History (35%) – Do you pay bills on time?

- Credit Utilization (30%) – How much of your available credit you’re using (keep it below 30%).

- Length of Credit History (15%) – How long you’ve had credit accounts.

- Credit Mix (10%) – Variety of credit (credit cards, loans, mortgage).

- New Credit (10%) – Too many recent applications lower your score.

🏦 Why Credit Scores Matter

- Loans: Determines if you qualify and what interest rate you’ll pay.

- Renting: Landlords often check your score before approving.

- Jobs: Some employers check credit for financial positions.

- Insurance: May affect your premium in some states.

👉 Example: A high credit score can save thousands on a car loan or mortgage through lower interest rates.

🛠️ How to Build & Improve Your Credit

- Pay bills on time — set reminders or autopay.

- Keep balances low — under 30% of your credit limit.

- Don’t close old accounts — longer history = better score.

- Apply sparingly — too many inquiries can hurt.

- Check your credit report — free annually at AnnualCreditReport.com.

✅ Quick Checklist

🔑 Key Takeaway

Your credit score opens (or closes) financial doors.

Manage it wisely, and you’ll save money, qualify for better housing, and build long-term financial stability.