Should you rent or buy a home?

It’s one of the biggest financial decisions you’ll ever make. Both options have benefits and drawbacks — the right choice depends on your lifestyle, finances, and future plans.

🛋️ Renting a Home

✅ Pros

- Flexibility: Easier to move for jobs, school, or travel.

- Lower upfront costs: Security deposit and first month’s rent vs. a large down payment.

- No repair costs: Landlord typically handles maintenance.

- Amenities: Many rentals include gyms, pools, or laundry.

❌ Cons

- No equity: Rent payments don’t build ownership.

- Rent increases: Landlord can raise rent at renewal (depending on local laws).

- Less control: Restrictions on painting, remodeling, pets, etc.

- Uncertainty: Lease may not be renewed.

👉 Best for: People who need flexibility, are saving for a home, or don’t want the responsibility of maintenance.

🏠 Buying a Home

✅ Pros

- Builds equity: Mortgage payments increase ownership over time.

- Stability: No landlord — you’re in control.

- Customization: Remodel, paint, or upgrade however you want.

- Potential investment: Home value may increase, building long-term wealth.

❌ Cons

- High upfront costs: Down payment, closing costs, inspections.

- Maintenance & repairs: Roofs, plumbing, appliances — all on you.

- Less flexibility: Harder to move quickly if job or lifestyle changes.

- Market risk: Home value can decrease in economic downturns.

👉 Best for: People planning to stay put for 5+ years and who are financially ready for long-term responsibility.

📊 Quick Comparison

| Factor | Renting | Buying |

|---|---|---|

| Upfront Cost | Low (deposit + 1st month rent) | High (down payment + closing) |

| Monthly Payments | Rent + utilities | Mortgage + taxes + insurance |

| Maintenance | Landlord handles it | You pay and manage repairs |

| Flexibility | Easy to move | Harder to move quickly |

| Long-term Benefit | No equity | Builds equity & potential wealth |

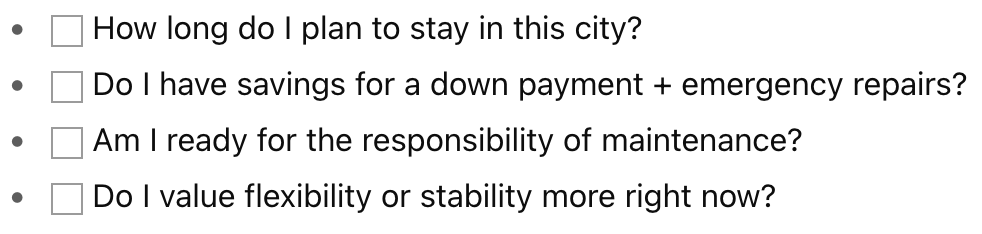

✅ Quick Checklist

Ask yourself:

🔑 Key Takeaway

Renting = flexibility, lower upfront costs, no repairs.

Buying = stability, ownership, potential long-term wealth.

Choose what fits your current stage of life and financial goals.